Mastering Advanced Forex Trading Strategies 1687400000

Mastering Advanced Forex Trading Strategies

Forex trading, or foreign exchange trading, involves buying and selling currencies in the global market. With the continuous evolution of the financial landscape, traders are now turning to advanced forex trading Trading FX Broker to enhance their trading strategies and refine their techniques. For those already familiar with the basics, moving to advanced strategies can greatly improve your performance and profitability. In this article, we will dive deep into some advanced forex trading concepts and techniques that experienced traders apply to gain an edge in the market.

Understanding Technical Analysis

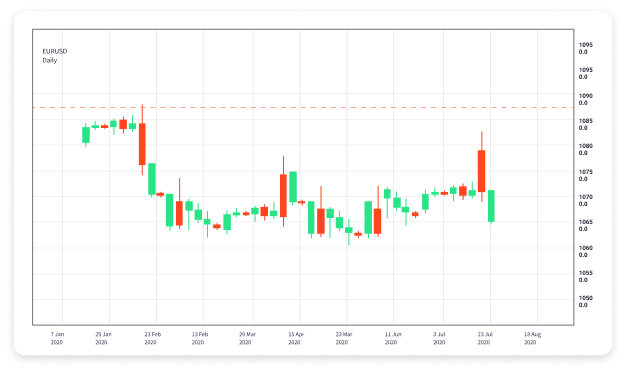

At the core of advanced forex trading is technical analysis. This approach involves using historical price data and chart patterns to forecast future market movements. Advanced traders often utilize various complex indicators and tools to make informed decisions. Here are a few essential elements of technical analysis:

Chart Patterns

Chart patterns, such as head and shoulders, triangles, and flags, are vital for predicting market trends. Advanced traders spend significant time learning to identify these patterns and understand their implications.

Indicators and Oscillators

There are numerous indicators available, such as Moving Averages, MACD (Moving Average Convergence Divergence), and RSI (Relative Strength Index). Advanced traders analyze multiple indicators simultaneously to confirm their trading signals and to filter out false ones.

Risk Management Techniques

Effective risk management is a cornerstone of successful trading. Advanced traders employ several advanced risk management tactics:

Position Sizing

Position sizing is about determining how much capital to risk on a single trade, which can significantly impact your overall trading equity. This usually involves calculating the percentage of equity you are willing to risk and adjusting your position size accordingly.

Leveraging Stop-Loss Orders

Placing stop-loss orders at strategic price levels can help mitigate potential losses. Advanced traders use dynamic stop-loss orders that adjust according to market volatility, often employing trailing stops that allow gaining positions to remain open while risking minimal loss.

Algorithmic Trading

Algorithmic trading is becoming increasingly popular among advanced traders. This technique involves using computer algorithms to execute trades based on predetermined conditions. Here’s how it can enhance trading strategies:

Speed and Efficiency

Algorithms can analyze market conditions and execute trades within milliseconds, ensuring that traders can capitalize on fleeting opportunities that manual trading might miss.

Emotionless Trading

By relying on algorithms, traders can eliminate emotional biases that often lead to costly mistakes. Trading based on logic instead of emotions can lead to more consistent results.

The Importance of Economic Indicators

Advanced traders pay close attention to economic indicators that can influence currency values. Understanding how various reports affect market sentiment is crucial for effective trading:

Interest Rates

Central banks use interest rates to control inflation and stabilize the economy. Changes in interest rates can have profound effects on currency values. Traders analyze interest rate decisions closely to forecast future market movements.

Employment Reports

Employment rates are a key indicator of economic health. Advanced traders monitor employment reports, such as Non-Farm Payrolls (NFP), to gauge potential currency fluctuations.

Psychology of Trading

Trading psychology plays a significant role in the success of advanced traders. Understanding one’s own psychology and the psychological impacts on market movements can give traders a significant edge. Here are some aspects to consider:

Fear and Greed

Fear and greed are two dominant emotions that can impact trading decisions. Advanced traders learn to recognize these emotions and implement strategies to counteract them.

Discipline

Discipline is key to maintaining a successful trading routine. Advanced traders adhere to their trading plans, regardless of market conditions, to avoid impulsive decisions.

Continuous Learning and Adaptation

The forex market is ever-changing, requiring advanced traders to adapt their strategies continuously. Engaging in continuous education through webinars, courses, and reading will keep you up-to-date with the latest trends and techniques. Here are a few approaches to keep learning:

Joining Trading Communities

Being part of trading communities can provide valuable insights and a platform for sharing experiences and strategies. It allows traders to learn from one another and stay motivated.

Backtesting Strategies

Advanced traders often backtest their strategies using historical data. This process allows them to fine-tune their methods and identify what works best in various market conditions.

Conclusion

In conclusion, advanced forex trading involves a blend of technical analysis, risk management, psychological understanding, and continuous education. By mastering these elements and utilizing resources like Trading FX Broker, traders can significantly elevate their trading capabilities. Remember, the key to success in forex trading lies not just in strategy, but also in discipline and adaptability.