Forex Trading Basics A Comprehensive Guide for Beginners 1936668125

Forex trading is a decentralized global market for the trading of currencies. It involves the buying and selling of currency pairs, where one currency is exchanged for another based on current market rates. As one of the largest financial markets in the world, forex trading offers ample opportunities for profit. In this comprehensive guide, we will cover the basics of forex trading to help beginners navigate this dynamic and exciting field. To learn more, visit forex trading basics https://forex-level.com/.

What is Forex Trading?

Forex, or foreign exchange, is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. Unlike stock trading, forex does not have a centralized exchange; instead, it operates 24 hours a day through a decentralized network of banks, brokers, and financial institutions. Traders participate in forex to speculate on the price movements of currency pairs, aiming to capitalize on fluctuations in exchange rates.

The Basics of Currency Pairs

In forex trading, currencies are quoted in pairs, such as EUR/USD or USD/JPY. The first currency in the pair is known as the “base currency,” while the second currency is the “quote currency.” The exchange rate indicates how much of the quote currency is needed to purchase one unit of the base currency. For example, if the EUR/USD exchange rate is 1.20, it means that 1 euro can be exchanged for 1.20 US dollars.

Major Currency Pairs

There are several major currency pairs that are most traded in the forex market. These include:

- EUR/USD: Euro/US Dollar

- USD/JPY: US Dollar/Japanese Yen

- GBP/USD: British Pound/US Dollar

- USD/CHF: US Dollar/Swiss Franc

- AUD/USD: Australian Dollar/US Dollar

Other pairs, known as “cross-currency pairs,” do not include the US dollar. Examples include EUR/GBP or AUD/JPY.

Understanding Forex Quotes and Pips

Forex quotes are presented in terms of “pips,” which stands for “percentage in point.” A pip typically represents the fourth decimal place in most currency pairs, except for pairs involving the Japanese yen, where it represents the second decimal place. For instance, if the EUR/USD moves from 1.1200 to 1.1205, that’s a movement of 5 pips. Understanding pips is crucial for calculating profits and losses in forex trading.

Types of Forex Orders

Forex traders use various types of orders to enter and exit trades. The most common types of orders are:

- Market Order: An order to buy or sell a currency pair at the current market price.

- Limit Order: An order to buy or sell a currency pair at a specified price or better.

- Stop-Loss Order: An order designed to limit potential losses by exiting a trade at a predetermined price.

- Take-Profit Order: An order to close a position once a specified profit level has been reached.

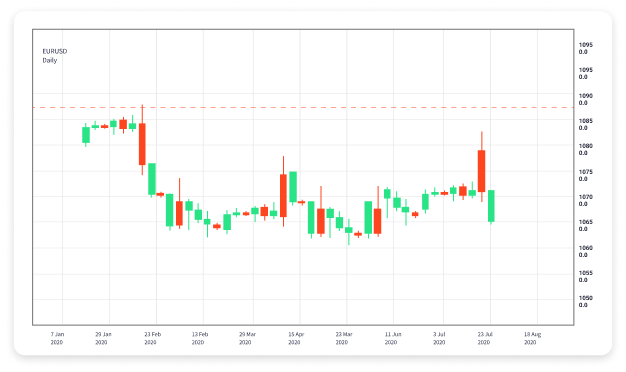

Technical Analysis and Charting

Technical analysis is a method of predicting future price movements based on historical data, using various tools such as charts, indicators, and patterns. Traders analyze price charts to identify trends, support and resistance levels, and potential reversal points. Some popular technical indicators include:

- Moving Averages: Used to smooth out price data and identify the direction of a trend.

- Relative Strength Index (RSI): Measures the speed and change of price movements to assess overbought or oversold conditions.

- Bollinger Bands: A volatility indicator that uses standard deviations to create bands around price movements.

Fundamental Analysis

In contrast to technical analysis, fundamental analysis involves evaluating economic indicators, news events, and geopolitical factors that influence currency values. Key indicators include interest rates, inflation rates, employment data, and GDP growth. Traders can use economic calendars to stay informed about upcoming announcements that may impact the forex market.

Risk Management in Forex Trading

Successful forex trading requires effective risk management strategies. This includes determining how much capital to risk on each trade and setting appropriate stop-loss levels. A common rule of thumb is to risk no more than 1% of your trading capital on a single trade. Additionally, diversifying your trading portfolio can help mitigate risks associated with market volatility.

Developing a Trading Strategy

A well-defined trading strategy is essential for consistent success in forex trading. Your strategy should outline your trading goals, risk tolerance, and the specific criteria for entering and exiting trades. Popular trading strategies include:

- Day Trading: Involves opening and closing trades within the same day.

- Swing Trading: Focuses on taking advantage of price swings over several days or weeks.

- Scalping: Aims to make small profits from short-term price movements.

Choosing a Forex Broker

Selecting a reliable forex broker is crucial for your trading success. When choosing a broker, consider factors such as:

- Regulation: Ensure the broker is regulated by a recognized authority.

- Trading Platform: Look for a user-friendly platform that meets your trading needs.

- Spreads and Commissions: Compare the costs of trading with different brokers.

- Customer Service: A responsive and knowledgeable support team is essential.

Conclusion

Forex trading offers exciting opportunities for profit, but it also comes with risks. By understanding the basics of forex trading, including currency pairs, pips, orders, technical and fundamental analysis, risk management, and trading strategies, beginners can position themselves for success. Continuous learning and practice through demo accounts can further enhance your skills and confidence. Whether you are aiming to trade part-time or full-time, building a solid foundation in forex trading will help you navigate this complex market.